The Challenge

In December 2017, Congress passed the Tax Cuts and Jobs Act (TCJA, or “tax reform”), constituting the largest change to the US tax code since 1986.

This piece of tax legislation represented a massive change to the business and our experience. Every major facet of tax law was touched, and all taxpayers and their outcome would be changed in some way, good or bad.

TurboTax needed to be made compliant with this legal mandate, and able to handle any concerns customers could have about how their tax outcome changed.

My Role

Tax strategy design lead for in-product experiences.

Understand tax reform impact & customer sentiment to create a design-driven strategy that maps solutions to customer problem areas across the end-to-end (E2E) experience.

Define hypotheses & concepts to align senior leadership and the organization on the vision and the journey.

Partner in multiple cross-functional teams to build shared understanding and execute toward our solutions and updates.

Direct other product designers, visual designers, content designers, and design researchers to craft, iterate and validate experiences that delivered awesome for our customers.

Discovering the problem space

Tax law changes and customer impacts

Nearly all customers (and taxpayers) were impacted by the law updates. Tax rate changes, updates to specific key credits and deductions, and new nuances and things to account for changed the landscape of how the customer would need to touch in TurboTax.

Most importantly, customers would expect a shift in overall outcome. Most would get slightly smaller increases their paychecks due to changes to tax withholdings, but would see lower refunds or more tax due upon completion of the tax return, putting a burden on the product to handle and explain the shift.

Tax law changes and expected customer impact

Learning customer sentiment

Product Marketing/Design Research and Customer Care outreach discovered that in general, taxpayers had little awareness of tax reform changes, outside of very generalized sentiments, specific niche topics, or socialized through political discourse (usually inaccurate).

Few believed the changes would impact them in a major way, and if it did, they trusted their tax prep solution to handle it as table stakes.

Initial sentiment research verbatims, broken out by tax filing method.

Synthesis and Problem Identification

Alignment with known TurboTax customer problems

Based on the initial customer research and tax analysis, the research team and I mapped the impact into the 8 general customer problems that TurboTax customer face as they file taxes. Conducting this mapping helped me framework the overall changes and identify user needs amplified by tax reform.

Relevant generalized customer problems in TurboTax, prioritized against tax reform impact

Breakdown of this specific customer problem - aspects of this problem that are present in tax prep, and how tax reform affects this problem

Implications & “How Might We…” Brainstorm

I worked with the research team to use the findings and customer problem mappings to further brainstorm additional implications and start thinking of initial levers for solutions. Building this document helped me immerse into the different types of solutions and influenced the strategy I would develop for tax reform.

Customer problem implications and “how might we’s” for solutioning distilled.

Strategy and Vision Definition

The Tax Reform Customer Problem

With our broad customer problem space defined, I pinpointed our customer problem and defined it as:

As a tax filer using TurboTax, I have little to no awareness of how tax reform affects my return, and am not expecting major changes to my outcome, especially if I had no life changes. I expect TurboTax to be on top of any changes that may have affected me.

If my outcome is different than what I expect, especially if it’s a negative change, then I need reassurance and confidence that the outcome I’m getting is the best outcome, so that I continue and finish my taxes and know that TurboTax has my back.

Design Principles

I created these design principles that would govern how we would approach the project and drive our ideation:

Tax reform is as relevant as I need it to be... unless I get impacted by it

Don't pre-emptively induce Fear, Uncertainty, Doubt (FUD)

Elevate & celebrate points of benefit whenever possible

Ensure customers understand their outcome, especially when tax reform forces different outcomes than expected

Success Metrics

Since this initiative was mandate driven, I took the stance that we should never lose a customer due to their tax reform changes. As such, the leadership team aligned on these metrics to reflect how we define success for this initiative:

No decrease to Start-to-Complete (S2C) percentages because of tax reform. Never lose a customer.

No decrease to Net Promoter Score (NPS). Customer sentiment should be at least flat, as they expect business as usual when they come to their taxes.

Increase helpfulness ratings for explanation experiences and capabilities (ExplainWhy, PONs, FAQs). Our experiences should help customers feel no fear, uncertainty, doubt about their return and give them the confidence to file to such an extent that they are delighted how we frame their outcome.

Defining Tracks of Work

Our mandate was to update the core experiences that were affected by the changes in tax law - mainly, sections that correspond to tax situation or form entry. However, there are a number of capabilities that exist throughout TurboTax to simplify and streamline the tax filing experience. Those existing capabilities would need enhancement, or new capabilities would need to be built to really solve the customer problem.

Going Broad

To explore and identify what would be needed, I led a Design For Delight (D4D) process (Intuit’s Design Thinking method) to identify ideas and narrow to capable solutions that we could validate through customer research.

To start, I called together a group of designers, researchers, marketers, customer care agents, tax experts, and product management to brainstorm solutions and features, aligned against each of the general TurboTax customer problems.

In driving the session, I walked the team through the landscape of changes with the context of the TurboTax E2E and implications, made sure we were familiar with the current capabilities of the product, then facilitated an ideastorm + affinity session to identify themes.

Outcome of D4D session focused on our customer problem areas.

Narrowing Opportunities

Looking at the ideas, and comparing against the largest areas of historical customer impact and FUD, the working team aligned on exploring three feature areas in product:

Explaining how withholding changes affected tax outcome projections when W-2 income is entered.

94% of customers have a W-2. We have the best chance to explain how your refund will shift best in the context of your paycheck withholdings, right after you enter the tax form for your income.

Enhancing the Standard vs Itemized Deduction (SVI) experience, which recommends the best method for applying the most effective deduction to lower effective income.

Half of returning customers who itemized in prior year (3 million) will be forced into taking Standard instead of itemizing, affecting this biggest deduction and causing FUD if this isn’t explained correctly.

Creating a new review experience once Federal Taxes are complete, to give customers a much more informative, confidence building view how they arrived at their final outcome.

In TY18, 174k customers abandoned while reviewing a summary of their outcome after Fed Review. Placing an explanation of tax reform impacts here could help customers understand their outcome.

Illustration of the highest opportunity areas (W-2 Withholdings, Update SVI, Final Review) called out against the major sections of the TurboTax E2E.

Hypotheses, Concepts and Sharing the Vision

For each of these three capabilities, I worked with Customer Care to distill the Voice of the Customer (VOC) to understand existing problems in the space and correlated them to expected new problems related to Tax Reform, as well as identified the customer segments affected by the change to focus the effort. I then created hypotheses for each major area affected. Once that was identified, another designer and I created concepts to illustrate potential solutions.

As each concept was tested and scoped within our cross functional team, my PM and I shared out to leadership to communicate which ideas seemed most promising and how we would commit the buildout.

Paycheck withholding concept, details, hypothesis + rationale

Content Strategy

As overall product design lead, I worked with the content design lead to craft the content strategy and voice + tone for how we would refer to tax reform in our experiences. Leveraging our principles and knowledge of the tax law changes, I leaned in with high-level guidance and inspired this strategy:

We use our empowering voice principles to speak to customers about changes due to tax reform. Our goal is to inspire confidence, reinforce accuracy, and ensure biggest refund.

Talk about tax changes, not “Tax Reform” - there’s negative or political connotations with that term. Focus on being informative and accurate.

Only tell customers what they need to know, elevate only at the point of impact.

Information related to Tax Reform should be discoverable (example - using a “What’s new” pattern), and made prominent only when it actually impacts the return.

This is a once-in-time change, so make sure tax reform mentions are compartmentalized.

We can minimize revisiting these experiences and ensuring the scope of change is minimized later on.

Example of “What’s New” content strategy pattern. Placing content mentions at the beginning and end of experiences so that customers can learn about changes up front, or when they’re actually impacted by the change.

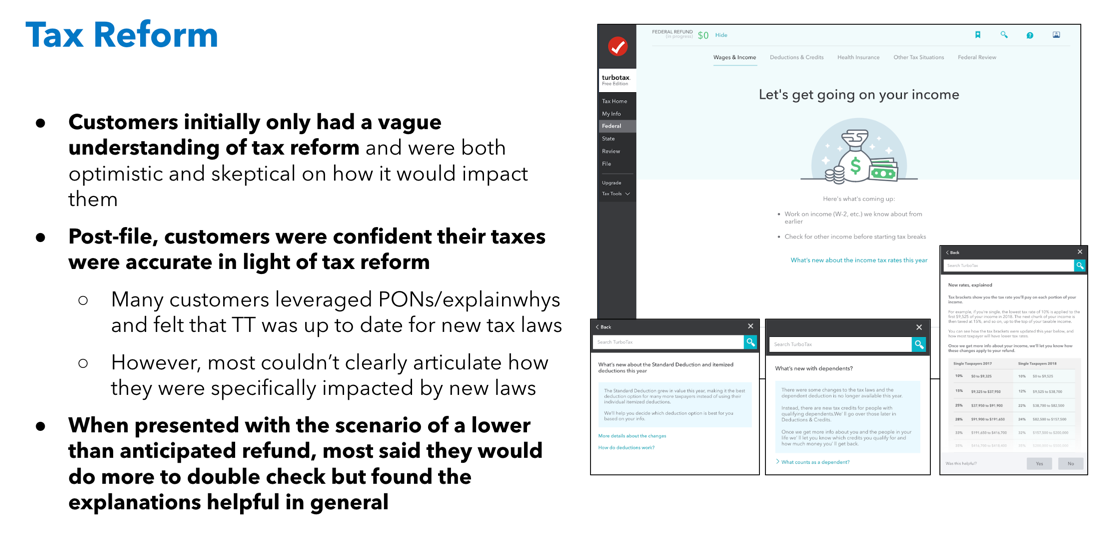

Validation Via Customer Research

Approach

The research team ran two rounds research - 1 round of concept testing, 1 round focused on usability - toward the end of the discovery phase. The objectives were:

Confirm our initial assumptions about customer sentiment about Tax Reform to validate our general strategy

Understand which concepts resonated with customers the most

Identify usability improvements we can iterate on

Evaluate the overall experience, and check if the changes to the experience disrupted the cohesion and flow of the customer journey

Concept Testing

In the first round of testing, customers were taken through a high-level look at the experience, focusing on each specific capability and variants of concepts. Winners were determined by a combination of positive user reaction, effectiveness in solving the customer problem, and gauging our ability to deliver the solution at the right fidelity for the season.

Planning the testing with my researcher - the full E2E, which sections and concepts we care most about are starred.

Link to full E2E concept prototype here.

Iteration and second round

In the second round, we took the winners from the first round, iterated on the concepts, and took the customers through a detailed walkthrough of the capabilities and compliance changes built so far in order to gauge usability and whether or not the E2E experience was cohesive.

We met our objectives in both rounds of testing - customers found the concepts helpful in understanding changes in tax outcome and clarifying aspects of Tax Reform. Most lacked deep understanding of the specific changes made through reform, but felt met at the point of need.

With our general messaging and capability approach validated, we progressed into executional delivery for all related experiences.

Concept test findings regarding the overall changes to the TurboTax E2E stemming from our tax reform assumptions.

Specific responsibilities after concept validation

We aligned on two core capability changes (narrowing from the original three - the withholding infographic was out of scope and was tuned down to content explanation). I led design efforts for the Standard vs Itemized Deduction experience, and another designer took on the Final Review capability. Beyond capability work, I led the strategy for all the general tax compliance design changes and execution for the bulk of those tax topics.

For this execution case study, I will focus on my design process around the Standard vs Itemized experience.

Standard/Itemized Deduction Recommendation

My Role

As design owner of the revamped Standard vs Itemized (SVI) experience, I…

Conducted audits and discovery to understand all customer problems within the SVI space and map them to Tax Reform.

Went broad with design thinking to approach the problems and scope the solutions.

Set expectations with all stakeholders and leadership on the vision.

Partnered with the CG Design System team to create a new pattern around data visualization to amplify explanations.

Worked on defining data model and business rule changes with PM and data science.

Tested concepts and iterated design through to final delivery.

Defining the Standard and Itemized Deductions

The Standard or Itemized deduction is the largest tax break most taxpayers are able to receive on their tax return.

The taxpayer chooses between the Standard Deduction, which is a set amount depending on the customers filing status, and a set of itemized deductions (including mortgage interest, property taxes, medical expenses, charitable donations, and losses due from a natural disaster).

This choice is crucial to ensuring the customer receives an ideal tax outcome by lowering their overall tax burden as much as possible.

How the experience originally worked

Generally, to determine their best outcome, customers have to input all their itemized deductions to see which deduction is higher, which is time consuming, complicated, and a waste of time if the customer ends up taking the standard deduction.

To help the customer make the best decision, TurboTax leverages a machine-learned model to analyze 25+ years of return records to predict if the customer which deduction the customer is likely to benefit from the most.

If the model determines that the customer will be likely to take Standard, the customer can opt-into taking a questionnaire meant to confirm the model’s prediction and educate the customer on what the deductions are and their impact. Once the customer is answers the questions, the customer is given a recommendation to either attempt to itemize, or to take Standard, which would follow up by blocking the itemized deduction experiences from being entered.

Having this experience is key. Approximately 20% of our customers (~6 million) itemized their deductions in 2017, and itemization is a key driver for customers to use TurboTax Deluxe, which is the SKU with the largest amount of paid customers.

Pitfalls from Tax Reform & Hypotheses

The SVI space was most heavily impacted by Tax Reform. The Standard Deduction doubled for all taxpayers, cutting in half the amount of customers who had would benefiting from itemizing. On its face, this seems to simplify the tax return.

However, roughly 3 million returning customers would be shifting from itemizing to taking Standard, and there were major reservations that these customers would not believe us at face value and would continue attempting to enter their itemized deductions.

Combined with our experience being optional and only 45% of customers in prior year going through it, I saw this as an opportunity to improve the experience and use it as a vehicle to explain tax reform, while being able to build confidence in TurboTax that we had changes covered.

I started on the SVI track by discovering customer problems and brainstorming concept ideas via conducting an expert review of the experience, VOC/data analysis, and cross-functional team solicitation.

Compiled customer problems (both stemming from Tax Reform + holistically), key segments affected, hypotheses and broad conceptual ideas.

Concept Definition Framework: Good/Better/Best

To organize the concepts and help articulate a tight, concise vision for how we could approach the work, I used a Good/Better/Best (GBB) framework across all touch points and surrounding context to highlight the case for change and the potential impact we could have for the customer.

In laying out the concepts through a GBB framework, I could demonstrate the spectrum of potential work along these themes:

Good: Barebone compliance changes

Better: Optimization for the core SVI experience and associated customer problems

Best: Reimagine the rest of the navigation and topics affected by the SVI decision

The GBB framework helped guide the working team scope the effort and determined what level of change the team felt comfortable in committing for future exploration and development.

The core SVI experience inside the Better swimlane (optimization against existing customer problems)

Full diagram available for viewing here.

Leadership Alignment

With the working team aligned, my PM partner and I went to our director and senior leadership teams for socialization of vision and organization alignment. We shared the tax reform impact, the broad experience changes needed, the hypotheses and concepts we were exploring, and how we were going to approach A/B testing after GoToMarket.

Tax reform hypothesis and concept shareout presentation slide.

Concept testing and narrowing our ideas

At this point, I partnered with my user researcher to stress test our concepts and start understanding which pieces of our concepts worked best for approaching the problem.

This testing was done with 6 remote participants. As this was research focused for all of Tax Reform, I create a prototype that simulated the entire tax filing experience, and inserted concepts for each major tax reform change, including SVI. For each area, the customer evaluated a concept through the course of filing taxes, then we showed them a comparison of concepts (when available) to solicit preferences and evaluate usefulness.

SVI concepts tested:

Initial framing and education: See if customers understand why we’re showing this experience and the impact

Questionnaire: Are the questions about each deduction understandable and easy to answer?

Recommendation: Do customers understand why we gave what recommendation, and do they trust us?

Topic blockers: If customers take a Standard recommendation, do they undo it, or try to go into itemized topics, see how we’ve deferred them from entering that experience and are OK with it?

SVI Recommendation concepts. We tested different ways to prove out the recommendation (visual and number comparison, breakdown of deductions, actual impact)

Link to concept comparison prototype here.

Link to full E2E concept prototype here.

Key learnings from testing:

Most understood that they didn’t need to enter itemized deductions, & liked saving time and extra steps.

Most assumed that more info was not needed for topics in SVI interview, but some checked anyways for multiple reasons. D&C topic blockers did not cause problems for them.

There wasn’t a lot of awareness and understanding of standard v. itemized and some didn’t notice a change since they were unsure what they took last year.

The more personalized the explanation we make around the recommendation, the more likely users will be to trust it.

Enhancing the Recommendation: Data Visualization

In focusing on improving the likelihood that customers would take the recommendation, we identified certain discrete elements out of the concepts that we wanted to hone and polish:

Showing real numbers that customers could believe and understand how TurboTax derived them

Integrating social proof (through the accuracy of our recommendation, driven by AI/ML)

Using motion and visuals to buttress the recommendation

I coordinated with CG Design Systems and Design Services teams to create a new foundational asset to showcase this recommendation (1 generalist product designer, 1 visual designer, 1 design technologist).

I defined use cases and design requirements for the team to kick them off. The team and I went broad in visual treatments and elements, narrowed through usability testing, and arrived on a solution that interlaced using visual hierarchy and numbers to tell a clear story of why this recommendation was best for you.

Requirement and use case case document I created for the CGDS team, with initial takes on concepts.

CGDS team ideation/go broad

Current data visualization asset implementation. Social proof tested well, but was pulled from the design mid-season due to legal concerns.

Usability testing

With our general improvements identified and iterated, I took the designs through a round of usability testing across the Tax Reform E2E. We used the same methodology as before with the first round of testing (full experience review with varied concepts, but focusing more on treatment of our specific designs with less divergence).

The learnings of this test demonstrated that we had made strides in building confidence that our numbers and estimates were good enough to take our recommendation, but for some users, particularly those who had been itemizing in years past, there was still work to be done to show more detailed information to support why they shouldn’t be going down the itemized path.

Overall, the experience builds confidence for simple users, though some of the deduction definitions aren’t completely clear

Users used to itemizing needed more reason to believe and detail to feel great about taking the recommendation.

Believability: Data model guidance and detailed breakdown

We hypothesized that by showing totals and a full list of relevant, known deductions as part of a breakdown, we could make the Standard recommendation feel foolproof for customers.

There were a few challenging items to work through. The data model we leveraged generated estimations for each type of itemized deduction we knew the customer had, and the model wasn’t tuned well for upper ranges. For instance, the model would generally calculate several thousands of dollars of charitable deductions, which usually wasn’t realistic for most customers.

To make sure we had believable numbers we could show the customer, my PM, data science partner and I decided to use business rules and show ranges based on amounts previously entered in through the course of tax prep. If the customer entered state taxes, we would subtract that out, then show ranges for charitable deductions and medical expenses that we could use in our estimate (if the customer had a home or losses from a disaster, we would let them itemize automatically).

We would then show those values in our estimation and echo back to the customer their answers, building their education and leveraging their answers to explain their likely itemizations would be lower than the Standard Deduction.

Whiteboard notes during all day workshop to determine what inputs and model rules needed updating.

Business rules driving the SVI questionnaire

We used the data model output and applied business rules to come up with realistic numbers that we could use as part of our recommendation to build the case to believe.

Final output

Other major areas affected by Tax Reform

Personalized Refund Explanation - Updating the final review experience to use ExplainWhy, a calculation based explanation capability to highlight key items that drove the customer’s final outcome.

The $4,000 deduction per taxpayer and dependent was eliminated in favor of increasing the Child Tax Credit by $1,000. We had to remove and add celebrations through these sections to account for the changes.

The Mortgage Interest deduction was severely curtailed for customers who had used money from a house loan on items not related to the house. We had to re-imagine the sequence of questions asked to ensure customers stayed compliant with reporting the right interest amounts.

Eligibility to write off W-2 Job Related Expenses were limited to members of the Armed Forces, qualified performing artists, certain government employees, and the disabled. Since this experience was on legacy technology, we had to replatform it onto the modern tech stack and focus on how to qualify and gently disqualify customers used to taking this deduction.

The QBI deduction was a major perk for Self-Employed customers, but required the customer to enter all their income and business situations before being able to calculate the deduction. The team had to find the right place in the E2E and determine how to anchor the experience somewhere in navigation.

Challenges

Resourcing Delivery

The major challenge we faced during this initiative was general resourcing.

The scope of the initiative was large enough that through the course of the tax season, we had to pull in and rotate through:

4 interaction designers

5 content designers

4 PMs

4 tax experts

Additionally, our development team wasn’t fully funded and allocated until 3 months before season launch in December.

I spent a lot of time needing to onboard and off board people throughout the project, and align on expectations and needs with my Design Program Manager and Project Manager.

Ineffective Escalations

I had to escalate multiple times through my Design Ops and leadership before there was a general understanding about the gaps. The resourcing changes occurring so late on project meant tight delivery times for the majority of the work, limiting the scope of innovation we could have done across the board. Limited testing was available to validate experiences that could have benefitted from customer sentiment, and we launched multiple experiences that were more genius-designed than customer-tested than I would have liked.

Lessons Learned

The lesson I took away: leadership assumed this project was taken care of through our typical operating mechanisms, when instead it needed special attention. Framing this initiative as a mandate detracted from the importance of delivery and funding, compared to other growth initiatives. To be successful, vision framing has to be accompanied with the promise of growth to get people to move for you.